Real estate is a dynamic sector that plays a crucial role in the economy, impacting individuals, businesses, and governments. Whether you’re looking to invest, buy a home, or just understand the market better, this blog will break down the essentials of real estate, along with key trends shaping its future.

What is Real Estate?

Real estate refers to land and any physical property attached to it, such as buildings, homes, or other structures. It is broadly categorized into four types:

1. Residential Real Estate: This includes properties where individuals and families live, such as houses, apartments, and condos.

2. Commercial Real Estate: These are properties used for business purposes, including office spaces, retail centers, hotels, and warehouses.

3. Industrial Real Estate: Properties used for manufacturing, production, and storage fall under this category, like factories and distribution centers.

4. Land: This includes vacant land, farms, and ranches, where properties have not yet been developed.

How Does Real Estate Work?

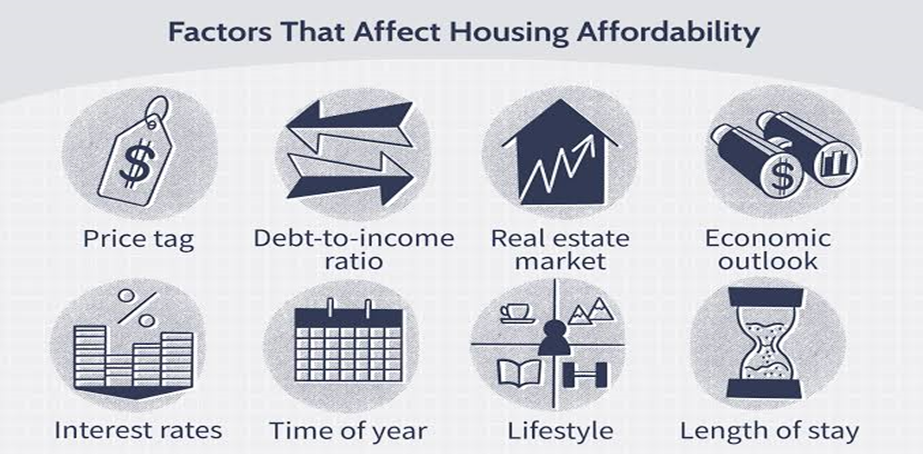

Real estate transactions are driven by market demand and supply. When supply is low and demand is high, prices rise. Conversely, when supply is high and demand is low, prices tend to fall. Several factors can influence real estate prices, including:

Location: Proximity to schools, public transportation, and employment centers can significantly affect property values.

Economic Indicators: Economic conditions such as interest rates, inflation, and employment rates impact the market.

Government Policies: Tax incentives, housing regulations, and interest rates set by the central bank also shape real estate trends.

Social Trends: Changes in demographics, such as a growing population or migration patterns, also influence real estate demand.

Why Invest in Real Estate?

Real estate is considered a tangible asset that can appreciate over time. It offers multiple benefits, such as:

1. Income Generation: Owning rental properties allows you to earn a steady income.

2. Appreciation: Over the long term, property values tend to increase, making real estate a potential source of capital gains.

3. Diversification: Real estate investments can balance out your portfolio, reducing overall risk when combined with other assets like stocks or bonds.

4. Tax Benefits: Many countries offer tax deductions for real estate investors, including deductions on mortgage interest, property taxes, and operating expenses.

Current Trends in Real Estate

1. Sustainability: As environmental concerns grow, more properties are being designed with sustainability in mind. Green buildings with energy-efficient features are becoming increasingly popular.

2. Technological Innovation: Technology is transforming the way real estate is bought, sold, and managed. Virtual tours, smart home devices, and blockchain for property transactions are reshaping the industry.

3. Work-from-Home Impact: The COVID-19 pandemic has led to a shift in workplace dynamics, with many opting to work from home. This has increased demand for larger homes or homes with dedicated office spaces.

4. Affordable Housing Crisis: Many urban areas face a shortage of affordable housing. Governments and private developers are working on solutions to make housing more accessible, such as rent control policies and public-private partnerships.

5. Rising Interest Rates: In some countries, central banks are raising interest rates to combat inflation. This has led to higher mortgage rates, which can slow down the real estate market as buyers become hesitant to take on expensive loans.

Key Considerations for First-Time Buyers

If you’re a first-time homebuyer or investor, keep these tips in mind:

1. Budget Wisely: Determine how much you can afford based on your income, savings, and credit score.

2. Location Matters: Research neighborhoods that show potential for growth, have good infrastructure, and meet your lifestyle needs.

3. Hire a Professional: Work with a real estate agent, lawyer, or financial advisor to guide you through the buying process.

4. Stay Informed: Keep an eye on real estate market trends, interest rates, and government policies that may impact your decision.

Conclusion

Real estate is a long-term investment that requires careful planning and research. Whether you’re buying your first home or investing in commercial properties, understanding market dynamics, key trends, and future opportunities is crucial for making informed decisions. As the market evolves, staying updated on technological advancements, sustainability efforts, and economic policies will give you an edge in navigating the complex world of real estate.